The Influence of Borrowing Solutions on Personal Finance and Economic Development

Offering solutions play an essential duty fit your personal money and the wider economy. They supply you with accessibility to capital, which can enhance your budgeting and economic preparation. This simple access likewise comes with possible risks. As you check out just how borrowing influences your financial decisions, consider the equilibrium in between opportunity and threat. What does this mean for your financial future and the economy at huge?

The Advancement of Loaning Services

As the monetary landscape has transformed over the years, lending services have advanced significantly to meet your needs. You have actually seen the change from traditional bank fundings to more versatile alternatives like peer-to-peer loaning and online platforms. These advancements have made it simpler for you to gain access to funds promptly and effectively.

Technologies in technology, such as credit rating formulas and mobile applications, have streamlined the application process, allowing you to protect financings with just a few clicks. In addition, different financing versions have actually emerged, giving options customized to your one-of-a-kind economic circumstance.

Regulatory changes have also contributed, making sure higher transparency and customer security. Today, you gain from a larger variety of alternatives, affordable rates of interest, and customized service. The development of financing services is all regarding adjusting to your needs, making it simpler for you to navigate your monetary journey.

Exactly How Lending Solutions Enhance Personal Financing

Offering services can play a vital role in your personal money monitoring. They help you gain access to capital, which can increase your budgeting and monetary preparation efforts while providing reliable financial obligation monitoring approaches. By understanding these devices, you can make more enlightened choices concerning your financial future.

Budgeting and Financial Preparation

Effective budgeting and economic planning are vital tools for achieving your economic goals, and leveraging financing solutions can considerably improve these procedures. By using loaning alternatives wisely, you can manage your cash flow a lot more effectively. An individual loan can cover unforeseen expenses, permitting you to stick to your spending plan without thwarting your long-lasting plans. Furthermore, charge card can assist you take care of temporary demands while gaining incentives, as long as you pay them off promptly. Using loaning solutions tactically allows you to allocate your resources better, ensuring you're prepared for both prepared and unforeseen financial challenges. With the appropriate method, these solutions can be integral to a well-structured monetary plan that brings about lasting security and development.

Access to Funding

When you have accessibility to offering services, you can fund your education and learning, begin a company, or acquire a home, all of which can greatly improve your monetary situation. With quicker accessibility to funds, you can additionally respond to emergencies, making certain life's unexpected events don't derail your monetary plans. Eventually, access to capital equips you to make educated economic decisions, leading the means for a more protected and prosperous future.

Debt Management Methods

The Duty of Fintech in Modern Loaning

As modern technology proceeds to evolve, fintech is reshaping the landscape of modern-day financing, making it much more easily accessible and efficient than ever before. You can currently look for loans with straightforward apps and web sites, bypassing standard banks' lengthy processes. With automated systems, choices on lendings take place in real-time, offering you quick feedback and the ability to secure funds nearly instantaneously.

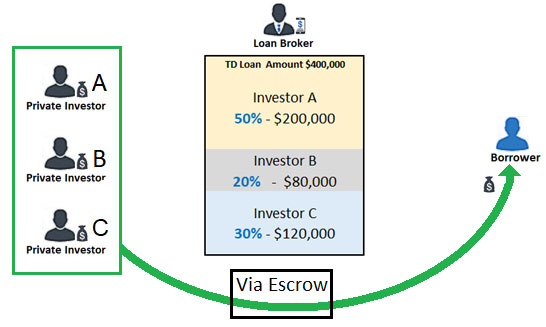

Fintech also utilizes innovative formulas to analyze your credit reliability, frequently considering factors past your credit report. This more comprehensive view means you might have more lending alternatives offered, also if you've dealt with difficulties in the past. Peer-to-peer financing platforms link debtors directly with capitalists, usually causing reduced rate of interest and a lot more favorable terms.

Customer Habits Moves Because Of Access to Credit Scores

Access to credit rating has actually transformed exactly how you spend and manage your financial resources (Private Money Lenders Atlanta). With even more available funds, you could locate yourself enhancing your investing practices without totally thinking about the lasting influence. It's important to be knowledgeable about the monetary dangers that come with this brand-new accessibility, as it can cause unanticipated difficulties

Increased Spending Routines

With the increase of debt schedule, several consumers find themselves welcoming enhanced investing practices that reflect a shift in their monetary behavior. You might locate yourself prioritizing experiences and high-end things over conserving, which can improve your financial priorities and way of life selections. Inevitably, these behaviors can greatly influence your long-lasting monetary health and wellness and financial landscape.

Economic Danger Understanding

While taking pleasure in the convenience of credit history, you could forget the financial dangers that come with it. Accessibility to credit history can lead to impulsive investing and a false feeling of protection concerning your financial resources.

As you readjust your investing habits, your understanding of monetary threats must expand. Eventually, welcoming economic risk recognition can equip you to use credit rating sensibly, ensuring your monetary health and wellness stays intact.

The Economic Effect of Increased Loaning

As borrowing rises, the causal sequences on the economic climate become this content increasingly obvious. When you look these up obtain lendings, you're fueling usage, which drives demand for products and solutions. This surge in costs encourages organizations to increase, employ more employees, and invest in brand-new jobs. Your borrowing likewise affects rate of interest; as need for credit history surges, lenders might change prices, affecting the total price of loaning throughout the market.

In addition, boosted borrowing commonly brings about greater customer confidence - Private Money Lenders Atlanta. When you really feel economically safe sufficient to obtain, you're likely to invest even more, resulting in economic development. This growth can create a favorable feedback loop, where businesses grow, tasks are developed, and wages boost, more enhancing costs

In significance, your decisions to borrow can militarize financial growth, influencing not simply your personal funds however the more comprehensive financial landscape. It's an effective cycle that shapes monetary security on numerous levels.

Dangers and Difficulties Related To Lending

Increased loaning can drive economic growth, yet it also features significant dangers and obstacles. When you handle financial obligation, you may deal with unforeseen monetary pressure if your revenue fluctuates or if rate of interest rates increase. This can result in a cycle of debt that's hard to escape. Furthermore, loan providers may not always have your ideal passions in mind, pushing you towards high-interest finances that can aggravate your economic circumstance.

You additionally take the chance of damaging your credit rating score if you miss out on settlements, making it more difficult to protect fundings in the future. By being conscious of the difficulties, you can navigate the lending landscape a lot more properly, ensuring that your borrowing sustains instead than prevents your financial goals.

The Future of Financing Solutions and Economic Development

The future of borrowing services holds the potential to significantly increase financial development, particularly as modern technology remains to change the financial landscape. You'll see loan providers utilizing advanced formulas and man-made intelligence to examine creditworthiness much more precisely, making it less complicated for you to secure lendings (Private Money Lenders Atlanta). Instantaneous authorizations and tailored offerings will boost your loaning experience, enabling you to gain access to funds when you need them most

Moreover, peer-to-peer loaning platforms will certainly acquire grip, attaching you straight with other consumers and financiers. This change not just democratizes accessibility to credit report however additionally cultivates neighborhood investment. As digital money and blockchain description innovation emerge, you'll witness much more safe and reliable transactions, lowering expenses for both lenders and customers.

Ultimately, as lending solutions advance, you'll enjoy better monetary possibilities, driving consumer spending and boosting economic development. Welcoming these developments can result in a much more flourishing future for you and the economic situation as a whole.

Regularly Asked Inquiries

Exactly How Do Rates Of Interest Affect Borrowing Decisions for Consumers?

What Are the Eligibility Needs for Different Loaning Providers?

To certify for various lending services, you commonly require to meet certain revenue, credit history score, and employment criteria. Lenders assess these variables to determine your eligibility and the terms they'll provide you.

How Can Individuals Improve Their Credit Rating?

What Defenses Do Consumers Have Against Aggressive Financing Practices?

You've got several defenses versus predative borrowing, like state and federal legislations that limit interest prices and call for clear disclosures. Coverage problems to authorities or looking for lawful recommendations can help you deal with unreasonable practices successfully.

Exactly How Can Borrowers Successfully Handle Their Debt After Taking Finances?

To efficiently manage your debt after taking loans, produce a budget, focus on settlements, and discover loan consolidation options. Remain notified regarding your finances and communicate with lenders if you face challenges; it'll help you remain on track.